Why Reconciliation Matters More Than Ever Annual GST compliance is no longer just a year-end formality. With increasing system-based validations, data analytics, and automated audit triggers on the GST portal, reconciliation under GSTR-9 and GSTR-9C has become a critical risk control mechanism. GSTR-9 consolidates all outward supplies, inward supplies, tax paid, and input tax credit...

Why 2026 Changes Matter and What This Article Delivers From late 2025, the GST ecosystem moved from permissive warnings to system-level hard validations that can block GSTR-3B submission when reclaimed ITC or RCM entries exceed ledger balances. This shift has fundamentally changed how monthly compliance must be handled. Filing is no longer just a reporting...

For many founders, the financial logic behind a global structure feels straightforward. Revenue flows to the overseas entity. Costs sit where operations happen. Margins look healthy. On paper, the numbers work. Yet this is precisely where many startups run into trouble. A global entity can appear profitable and commercially sound while still failing every serious...

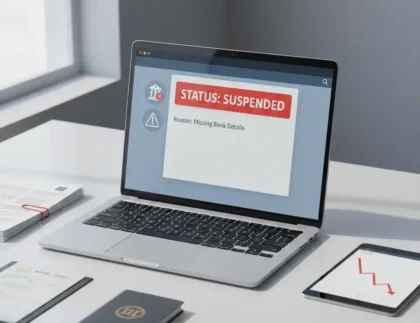

A Small Compliance Gap That Can Halt Operations In 2026, GST compliance is no longer limited to filing returns on time. The system now relies heavily on data validation, cross-verification, and automated risk flags. One of the most overlooked triggers for disruption is failure to furnish or validate bank account details on the GST portal....

For many founders, the first overseas hire feels like a small operational decision. One employee. One contractor. One role to support sales, tech, or customer success in a new market. Compared to incorporation, fundraising, or market entry, it seems almost administrative. In reality, that first overseas hire is often the moment a startup’s compliance model...